Retirement Plan Services

In today’s fast-paced business environment, managing retirement plans efficiently is essential for businesses in regions like Pittsfield, Springfield, Albany, Amherst, Holyoke, and Northampton. A well-structured retirement plan can significantly contribute to employee satisfaction and help companies retain top talent. This guide delves into the intricacies of retirement plan services and offers insights into how businesses can streamline their pension payroll processes.

Understanding the Importance of Pension Payroll Management

Pension payroll management is more than just processing numbers; it’s an integral part of a company’s employee benefits strategy. For businesses in industries such as retail, healthcare, education, and manufacturing, effective management of retirement plans helps ensure compliance with state and federal regulations, while fostering trust and loyalty among employees.

Related Subtopic: Enhancing Employee Satisfaction

Ensuring employees understand and value their retirement benefits is crucial. Providing clear communication and educational resources about these benefits can increase engagement and satisfaction.

Related Subtopic: Minimizing Compliance Risks

Staying informed about the latest payroll regulations and proactively managing retirement plans can prevent costly penalties and legal issues.

Key Benefits of Effective Pension Payroll Management

Businesses that prioritize effective pension payroll management enjoy numerous benefits, including attracting and retaining top talent, enhancing operational efficiency, and maintaining compliance with ever-changing regulations.

Attracting Talent

A competitive retirement plan can be a deciding factor for potential employees when considering job offers. Providing attractive pension options demonstrates a company’s commitment to employee well-being and future security.

Retaining Employees

Implementing a robust retirement plan can lead to higher employee retention rates. Employees are more likely to remain with an organization that values their long-term financial stability.

Compliance Assurance

Staying updated on regulatory changes is critical for avoiding penalties. A well-managed retirement plan ensures businesses remain compliant with state and federal guidelines.

Operational Efficiency

By streamlining pension payroll processes, businesses can allocate resources more effectively towards core operations, enhancing overall productivity.

Strategies for Maximizing Retirement Plan Services

To fully leverage the benefits of retirement plans, businesses need to adopt strategies that align with their operational goals and employee needs.

Integrating Technology for Seamless Management

Embracing advanced payroll software allows businesses to automate calculations, deductions, and contributions. This technology facilitates real-time reporting and ensures compliance with the latest payroll regulations.

Related Subtopic: Streamlining Processes

Automating repetitive tasks reduces administrative burdens and enhances accuracy, allowing businesses to focus on strategic initiatives.

Related Subtopic: Data Security

Implementing secure technology solutions ensures sensitive employee data is protected against potential breaches.

Customizing Plans to Fit Employee Needs

One-size-fits-all retirement plans often fail to meet the unique needs of a diverse workforce. By customizing plans to reflect employee preferences, businesses can boost participation rates and satisfaction.

Related Subtopic: Tailored Communication

Providing personalized benefits packages with targeted messaging can improve understanding and engagement.

Related Subtopic: Feedback Collection

Using surveys or focus groups to gather insights helps in creating more effective and appreciated retirement solutions.

Educating Employees on Retirement Benefits

Many employees are unaware of the full scope of their retirement benefits. Offering educational resources and workshops can empower them to make informed decisions about their future financial planning.

Related Subtopic: Interactive Workshops

Hosting sessions that engage employees in discussions about retirement options can enhance their understanding and involvement.

Related Subtopic: Support Tools

Providing access to retirement planning tools ensures employees have the resources they need to make wise financial choices.

Ensuring Compliance with Regulations

Compliance is critical in pension payroll management. Staying up-to-date with regulatory changes and working with experts can significantly reduce risks.

Regular Audits and Reviews

Regularly reviewing retirement plans helps identify areas for improvement, ensuring that businesses maintain compliance and operational efficiency.

Related Subtopic: Identifying Gaps

Through thorough audits, businesses can pinpoint inconsistencies and correct them before they lead to complications.

Related Subtopic: Proactive Monitoring

Consistent monitoring helps adapt to changes in legislation, ensuring continuous compliance.

Staying Informed on Legislative Changes

Keeping abreast of legislative developments is essential for maintaining compliant and effective retirement plans. Attending industry events and subscribing to relevant newsletters can provide valuable insights.

Related Subtopic: Networking Opportunities

Engaging with industry peers offers a platform to share knowledge and strategies for managing compliance.

Related Subtopic: Continuous Learning

Ongoing education helps decision-makers stay prepared for new regulatory requirements.

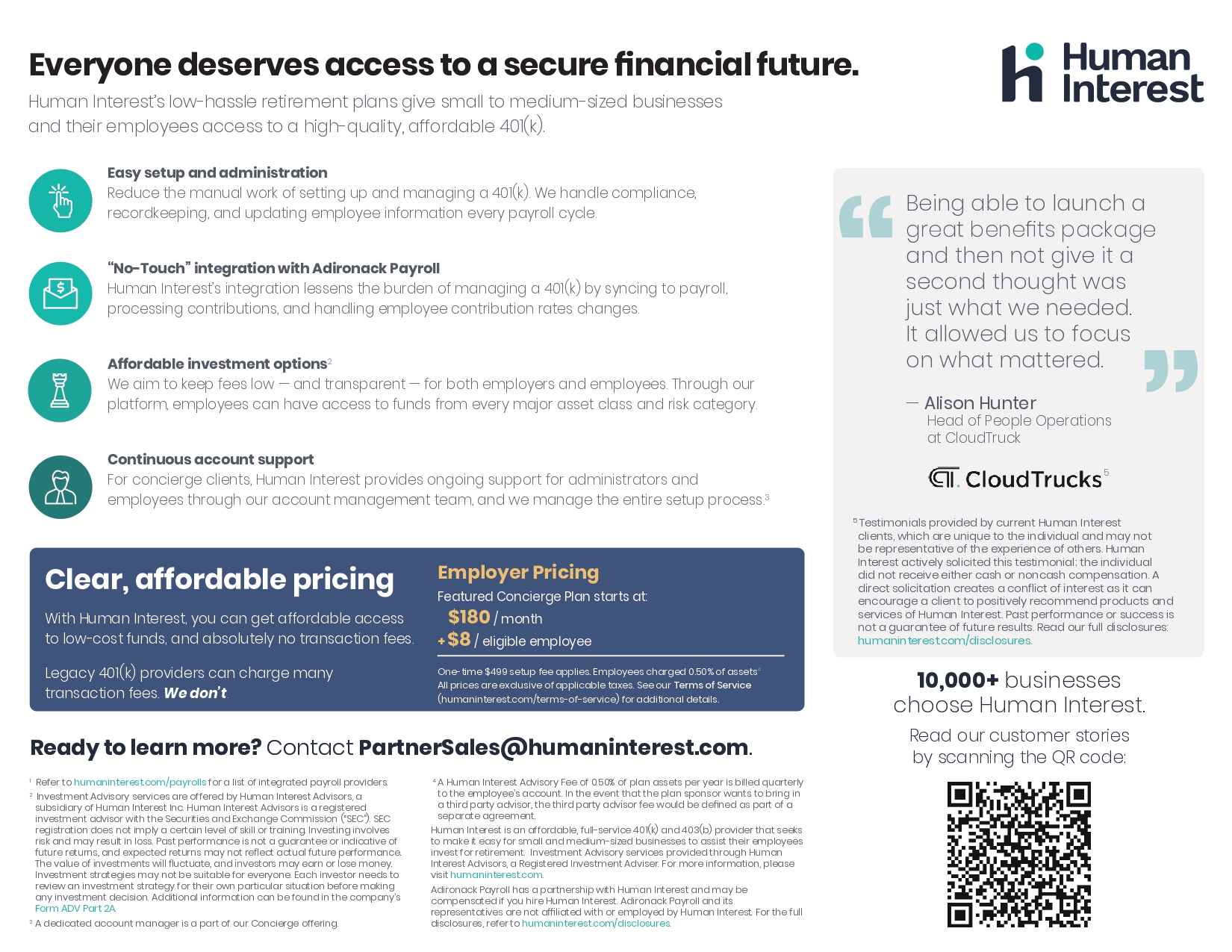

How Adirondack Payroll Services Supports SMEs

Adirondack Payroll Services is dedicated to helping small to medium-sized enterprises in Western Massachusetts and Eastern New York manage their pension payroll efficiently. Our tailored solutions ensure compliance, streamline operations, and enhance employee satisfaction.

Personalized Payroll Solutions

We work closely with our clients to design custom payroll solutions that align with their unique business needs, helping to optimize retirement plan offerings for diverse workforces.

Related Subtopic: Flexible Integration

Seamless integration with existing HR and accounting systems streamlines processes, enhancing overall operational efficiency.

Related Subtopic: Cost Management

Custom solutions allow businesses to balance cost and quality, ensuring affordability without sacrificing effectiveness.

Expert Compliance Guidance

Our team of experts stays informed about changes in payroll regulations and offers proactive guidance to keep businesses compliant.

Related Subtopic: Legislative Updates

Regular updates ensure businesses are prepared for shifts in retirement plan regulations.

Related Subtopic: Risk Mitigation

Effective compliance management minimizes the risk of penalties and legal repercussions.

Seamless Integration with Existing Systems

We understand the importance of seamless integration, offering payroll solutions that work seamlessly with existing software to enhance data accuracy and operational efficiency.

Related Subtopic: Real-Time Data

Real-time reporting allows for quick adjustments and accurate management of retirement plans.

Related Subtopic: Automated Processing

Automating repetitive payroll tasks frees up resources, allowing businesses to focus on strategic growth.

Building Long-term Relationships

Adirondack Payroll Services emphasizes personalized service and customer satisfaction, helping businesses build lasting relationships based on trust and collaboration.

Responsive Customer Support

Our dedicated customer support team is always available to address questions or concerns, ensuring smooth and efficient payroll operations.

Related Subtopic: 24/7 Accessibility

Providing round-the-clock support helps businesses maintain continuous payroll management.

Related Subtopic: Personalized Assistance

Tailored guidance ensures businesses receive the specific support they need for their retirement plan services.

FAQs

- What is the importance of retirement plan services for SMEs?

Retirement plans are essential for attracting and retaining top talent while ensuring compliance with payroll regulations.

- How does technology improve pension payroll management?

Technology automates calculations, facilitates compliance, and streamlines reporting, reducing administrative burdens.

- What strategies can businesses adopt to customize retirement plans?

Customizing plans through surveys, focus groups, and targeted communication can enhance employee satisfaction and participation.

- How does Adirondack Payroll Services ensure compliance with changing regulations?

Our experts provide regular updates and guidance to help businesses navigate evolving payroll laws and maintain compliance.

- Why is personalized service important in managing retirement plans?

Tailored solutions help businesses address unique workforce needs, fostering long-term relationships and employee engagement.

For more insights on maximizing retirement plan services, contact Adirondack Payroll Services at info@adirondackpayroll.com. Let us guide you through effective pension payroll management tailored to your business needs.